About Project

To simplify the home insurance claims process by enabling customers to self-serve from start to finish with minimal to no human intervention for simple claims. This approach aims to streamline straightforward claim settlements and automate processes, allowing for better resource allocation and efficiency.

BFSI Client's Background

A leading bank, aiming to become the top home insurer in the UK, is undergoing a significant digital transformation. The initiative addresses challenges related to complex backend operations and disjointed digital experiences for home insurance claimants.

Major Focus Area

1. Customer Experience Improvement

Elevating the self-service experience for both banking and non-banking

insurance customers to ensure a seamless claims journey.

2. Process Streamlining

Automating backend operations to enhance efficiency and reduce manual intervention.

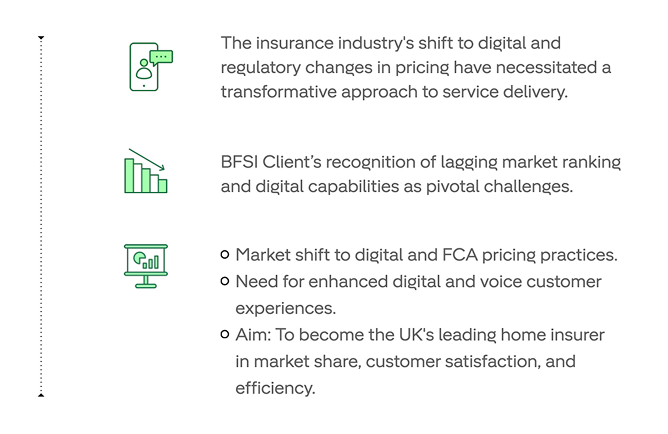

Digital Transformationin Home Insurance: A Necessity, Not a Choice

Understanding our Starting Point, Current State Analysis: Where We Began

Overview of BFSI Client’s position as a top 3 home insurer with significant gross written premiums but limited digital interaction with customers.

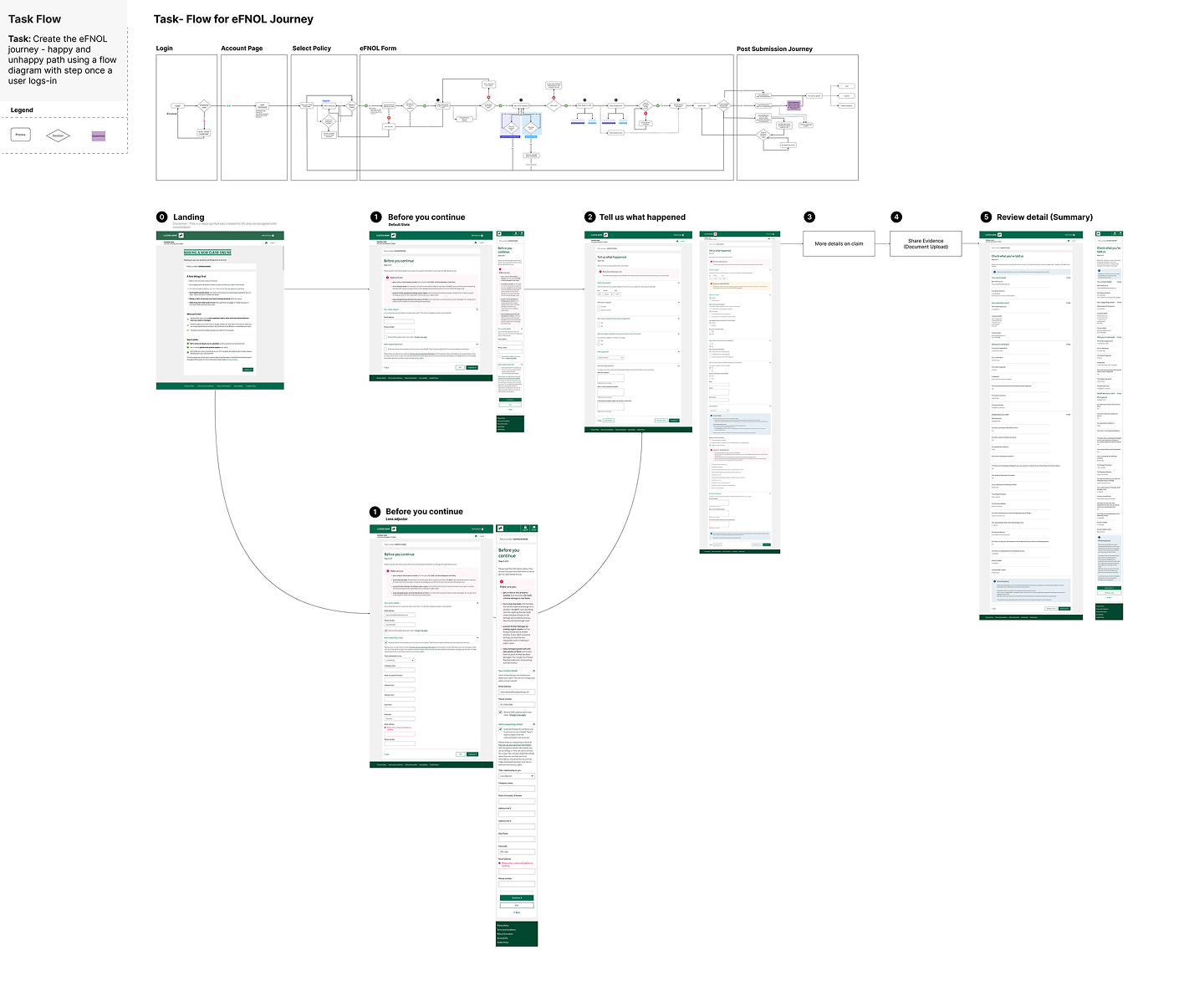

UX Design Goals: Simplifying Claims for Customers

Emphasis on creating an intuitive, frictionless digital experience for filing and tracking claims.

1. Design an easy-to-navigate digital FNOL process.

2. Enable straight-through processing for simple claims.

3. Develop a comprehensive digital claims portal for enhanced customer engagement.

Transformation Journey: Current vs. Future State

Comparative analysis of the current and future states, highlighting key improvements in digitalisation and customer interaction.

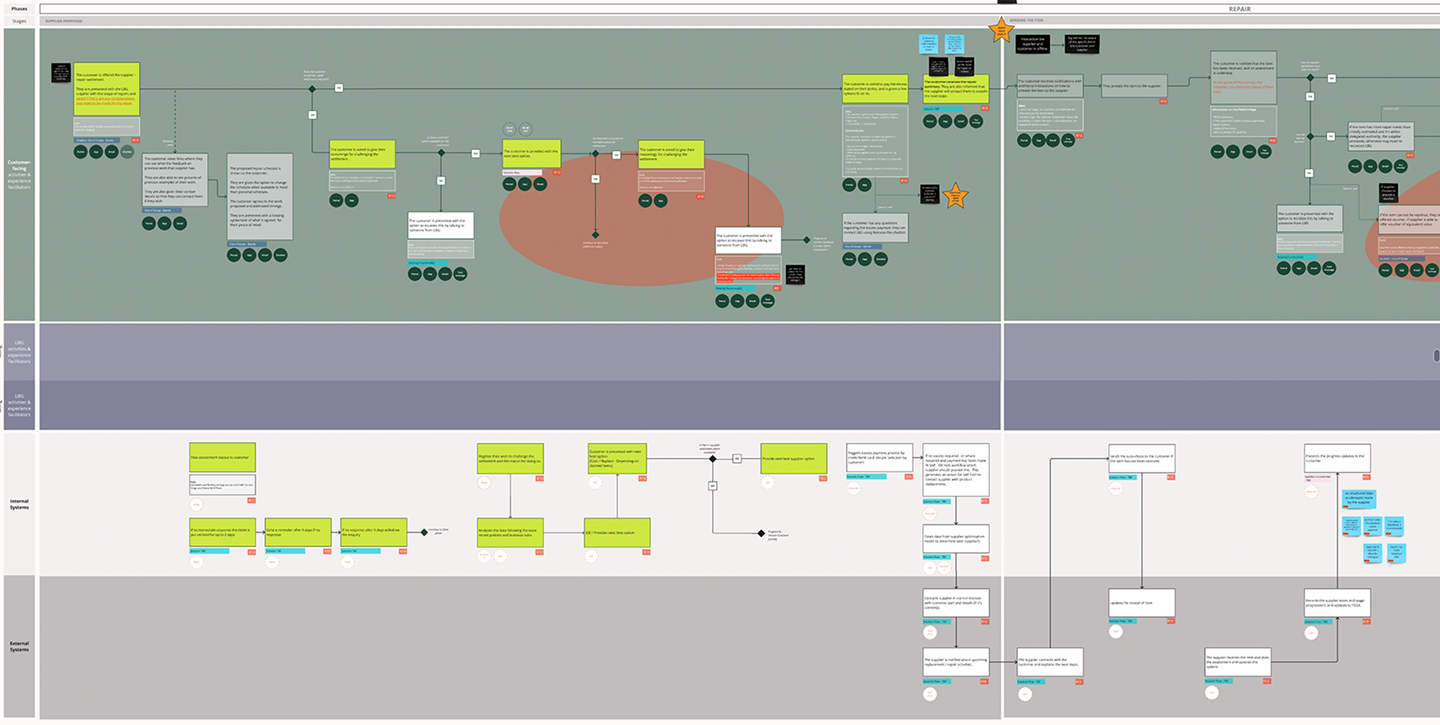

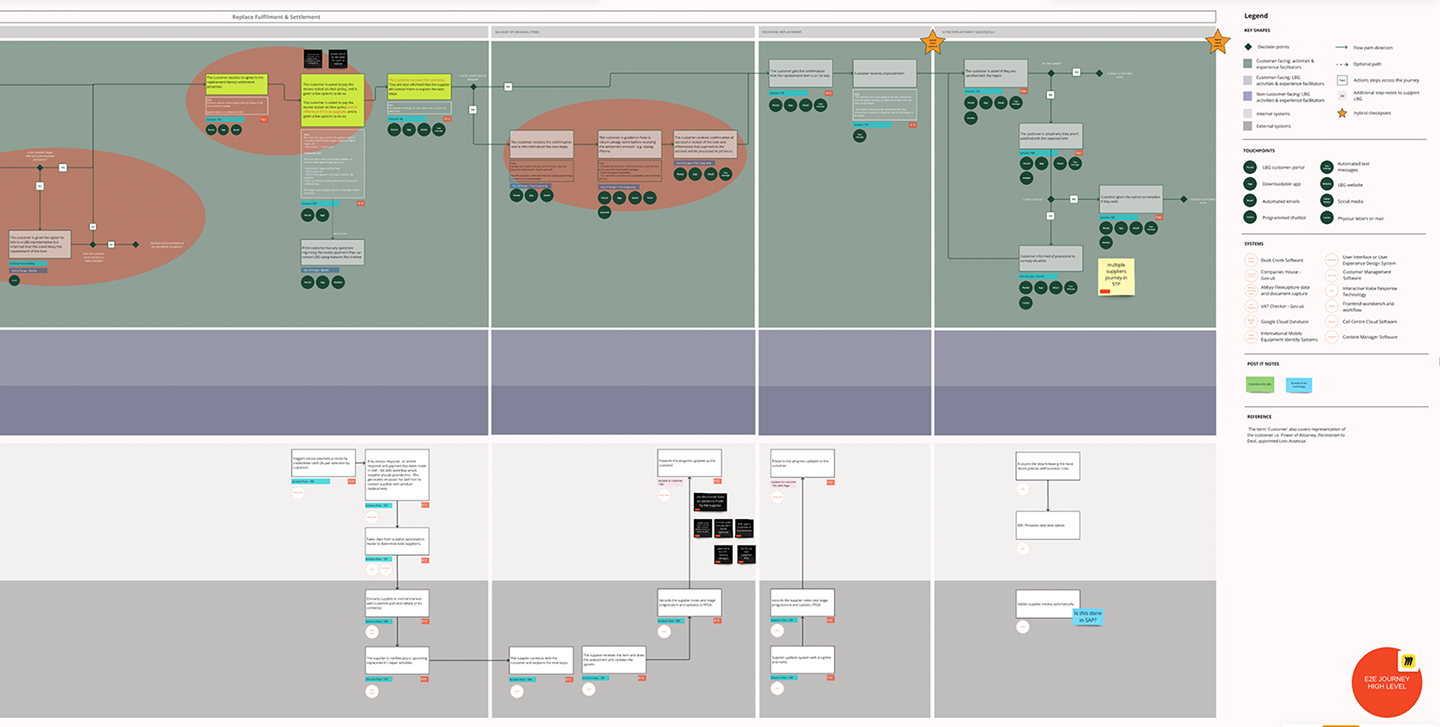

Snapshot of Service Design Blueprint for Customer Journey Mapping

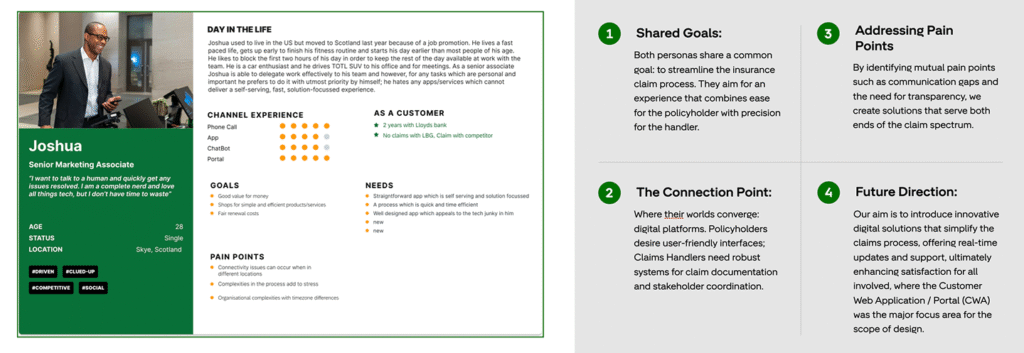

Bridging Customer & Claims Handler Personas

Policy Holder Persona

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Claims Handler Persona

Strives for accuracy and regulatory compliance. Faces challenges with complex claims and interdepartmental communications, seeking integrative solutions for efficiency.

Design Approach: Enhancing the UX Journey

3. Adherence to Standards: Adhered to the bank’s proprietary internal design system, ensuring consistency with existing frameworks and brand identity. Instituted design reviews with bank’s design authority and approval bodies to affirm commitment to user-centred principles, along with adherence to usability and accessibility standards.

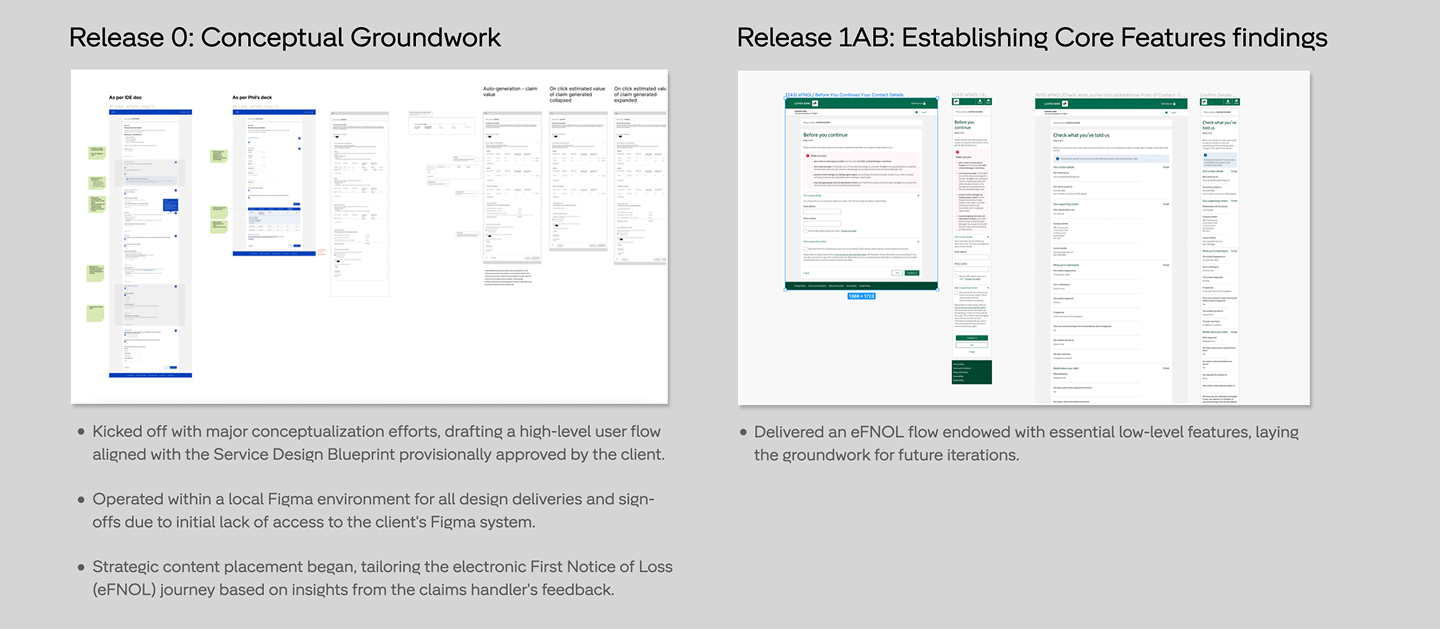

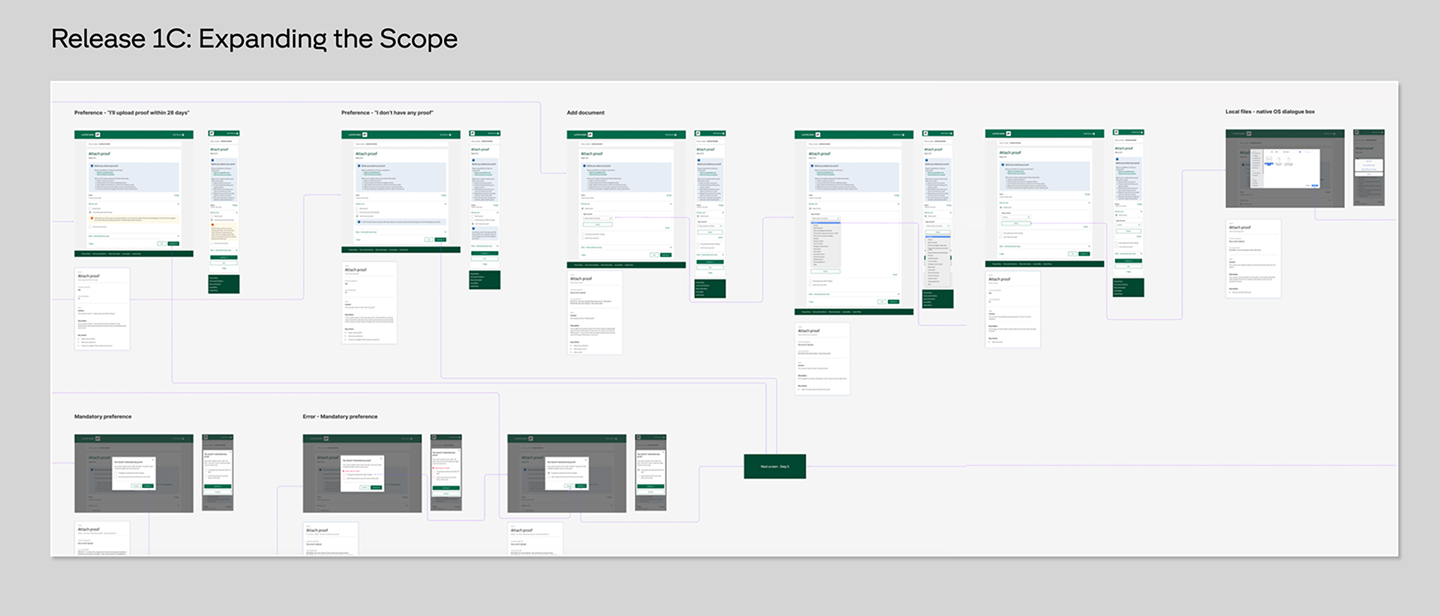

Evolution of UX Design Across Phased Releases

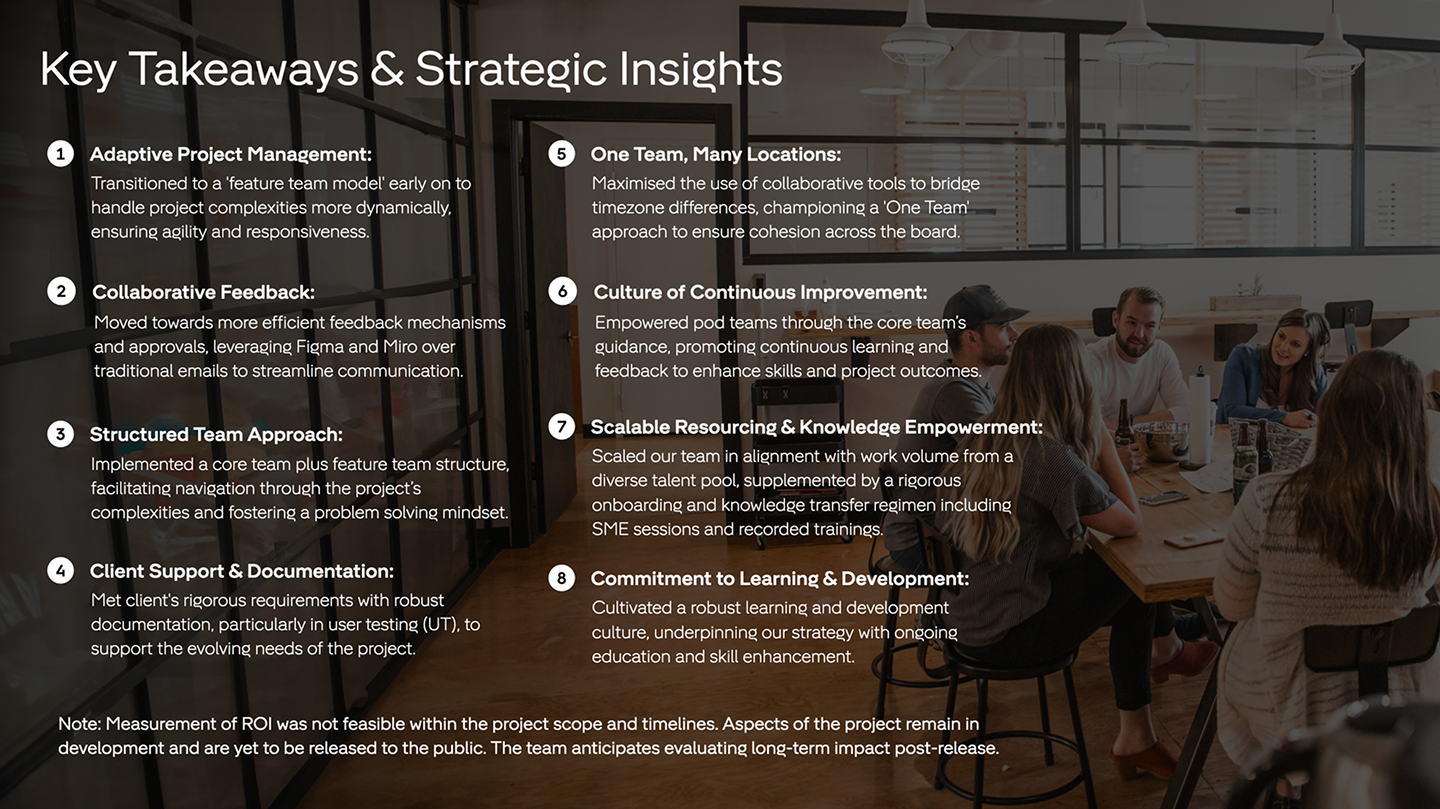

Takeaway